Dubai-based startup Stake is providing retail buyers from throughout the globe to purchase fractions of rental property in UAE’s marquee metropolis and earn common revenue. The startup, present in 2020, claims that due to Dubai’s real-estate guidelines it has managed to draw investing customers on the platform from over 80 nations on this planet.

The corporate, based by Manar Mahmassani, Rami Tabbara, and Ricardo Brizido in 2020, has raised $8 million in a pre-Sequence A spherical from buyers like BY Ventures, MEVP, and Vivium Holdings to broaden its portfolio and launch in Saudi Arabia and Egypt. The corporate first raised a $4 million seed spherical final yr.

“This spherical is a testomony to what we’re constructing at Stake and our mission to deliver entry and liquidity to the oldest, largest, and most sought-after asset class on this planet. The proceeds will enable us to broaden into Saudi Arabia and Egypt, proceed attracting one of the best expertise to the group, and cement Stake’s place because the class chief within the MENA area,” Mahmassani stated in a written assertion.

Tabbara informed TechCrunch over a name that after being in the actual property enterprise for over 15 years, he realized that lots of people wish to put money into MENA area however they’ll’t afford to place in massive chunks of cash with out paying enormous commissions to brokers and builders. So he wished to speed up the method of investing in actual property with Stake.

Picture Credit: Stake

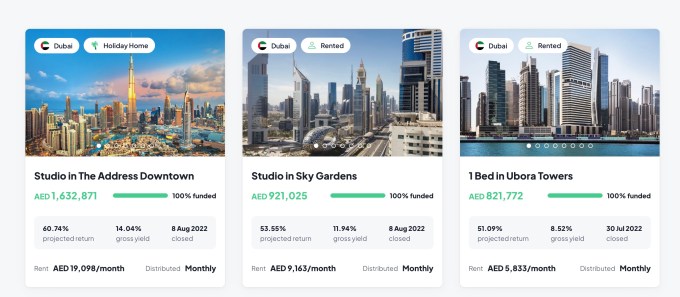

The agency says it lists premium properties on its platform which are already on hire. To accumulate a property, Stake seems at elements like location, construct high quality, view, and if it has tenants. Tabbara stated if the property isn’t rented, the corporate makes use of its information to checklist properties that may very well be rented out shortly. Stake has paid over AED 1 million ($272,249) in rental revenue to buyers, which is credited each month.

Stake presently manages greater than 44 properties with a mixed worth of AED 56 million ($17.9 million). The corporate claims that it has achieved a mean 17% month-to-month development fee in each buyers and property beneath administration (AUM).

“Our platform presently boasts 42,000 registered customers and greater than 2,100 lively buyers on the platform. Whereas we now have customers from many nations on the location, people from UAE, Saudi Arabia, Kuwait, the UK, and India are our prime 5 investor bases,” Tabbara stated.

Customers can shortly register with the platform and make investments from as little as AED 500 ($136). Due to Dubai’s funding guidelines particular person buyers can solely make investments as much as AED 183,500 ($50,000) per yr. The proptech firm additionally limits most possession by a single investor in a property to 33% to evenly unfold out features.

The agency doesn’t depend on financing to amass houses. All the cash to buy a property comes from the buyers. Whereas Dubai’s property rule permits for partial deeds, there’s a cap of 4 buyers, so Stake creates a particular objective automobile for every property to facilitate deed registration. All properties often have an funding time period of 5 intervals, however a home’s worth goes up 30% out there, and the buyers can vote to promote it.

Stake’s enterprise mannequin depends on varied charges. When buyers buy a property, the corporate expenses them 1.5% with an extra 0.5% charged yearly for upkeep. Plus, there are 0.2% Know Your Buyer (KYC) and Anti-money laundering charges upfront and 0.1% yearly from the second yr of the time period. The corporate additionally expenses buyers 2.5% as an exit price once they promote their stake. What’s extra, if the property is bought at a better fee than its acquisition, Stake takes a 15% reduce from the revenue. The corporate isn’t worthwhile but however has achieved 470% year-on-year development when it comes to income.

Within the subsequent 12 months, aside from launching its platform in Egypt and Saudi Arabia, the corporate additionally desires to construct a second-day buying and selling platform, the place buyers can promote their stake in a property to different buyers. Stake is specializing in launching a approach to let individuals put money into trip properties that go on platforms like Airbnb — one thing that platforms like Komoco and Right here are attempting within the U.S.

Within the native market, Stake’s closest competitor is SmartCrowd, which raised a $3 million bridge spherical in June. Tabbara claims that his firm has already surpassed SmartCrowd in the case of AUM.

“We’re banking on our group, expertise, and expertise in coping with totally different properties to turn out to be probably the most distinguished actual property funding platform within the Center East and North Africa (MENA)” area,” he stated.